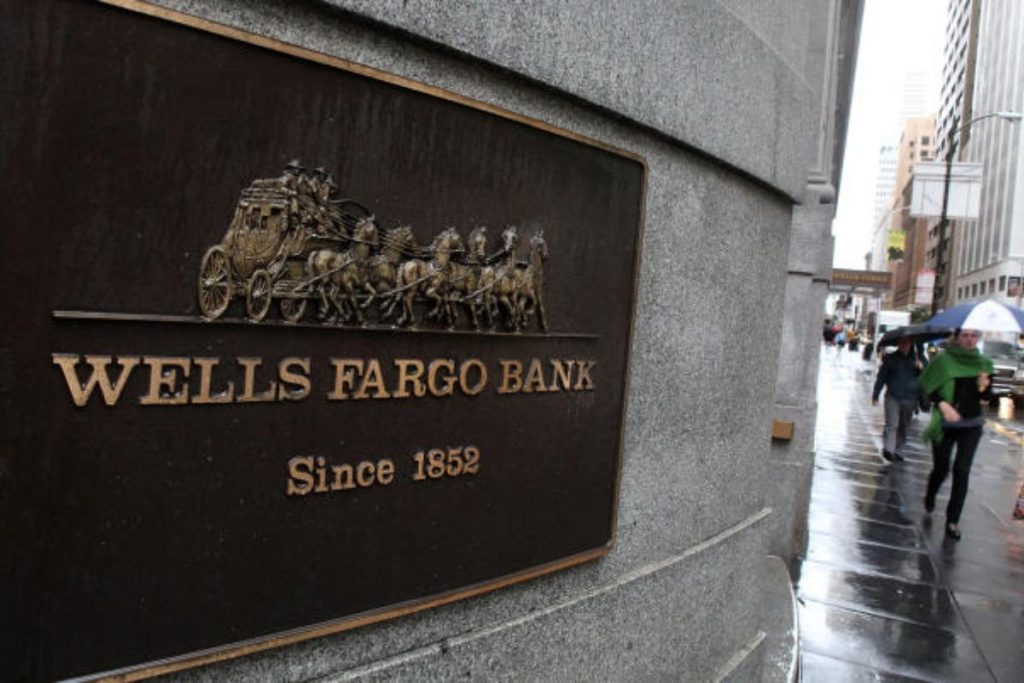

The Office of the Comptroller of the Currency (OCC), which is in charge of overseeing U.S. banks, has once again taken action against Wells Fargo. These problems are mostly with its efforts to stop financial crime and money laundering (AML).

Wells Fargo hit with enforcement action over AML deficiencies as the OCC directs the bank to implement significant changes to improve adherence to U.S. sanctions and the Bank Secrecy Act (BSA), though no fines are being sought at this time.

What the Enforcement Action is Based on

In its official order, the OCC points out several major problems with Wells Fargo’s internal processes. Some of these holes are not doing enough research on customers, not reporting fishy activities and currency transfers, and problems with finding customers and figuring out who really owns the money.

From now on, the bank has to get permission from the OCC before starting new business in areas where there is a higher chance of moving money or breaking penalties.

Wells Fargo has been under a lot of attention for years because of its AML procedures, and this new enforcement action highlights the bank’s ongoing challenges. Recently, Wells Fargo hit with enforcement action over AML deficiencies, continues to draw scrutiny.

What did the bank’s leaders say when asked about the problems? “We have made substantial progress on addressing many of the items in the agreement, and we are dedicated to completing the necessary work with the urgency it requires.”

An Increasing Number of Issues with Rules

This new court move is another example of how Wells Fargo has had a lot of trouble with the government in the past. In 2016, the bank had a bad reputation because of the fake account scandal.

It cost the bank billions of dollars in fines and claims from owners. Since then, it has been hard for the bank to win back regulatory trust. For as hard as CEO Charlie Scharf has worked since he took over in 2019, Wells Fargo is still not meeting government requirements.

The new move by the OCC shows that Wells Fargo still needs to do a lot of work to get up to speed with the law. He said that the bank has been in a “cleanup process” for a long time and that the new lawsuit shows that it is still being closely watched

Chris Marinac is the Director of Research at Janney Montgomery Scott. Marinac said, “This issue will likely persist,” which means that Wells Fargo’s path to recovery is still unclear and full of problems.

Can Wells Fargo Fix Its Issues?

The Federal Reserve’s asset cap, which means the bank can’t grow its assets beyond $1.95 trillion until its internal control problems are fixed, is one of the most important problems for Wells Fargo right now.

The bank hasn’t been able to grow much because of this cap, and if they don’t meet safety standards, the limit could be extended. In the beginning of the year, there was some hope on the financial markets that the asset cap could be lifted.

That being said, the new OCC enforcement move related to Wells Fargo hit with enforcement action over AML deficiencies makes this less likely.

“Earlier this year, there was some false hope that the asset cap would soon be lifted, but the most recent events show that Wells Fargo still has a lot of work to do,” Marinac said.

What the Market Did: Loss at Wells Fargo

The market has had a range of responses to the OCC’s legal action. Wells Fargo’s stock dropped as much as 6.5% at first, but it slowly rebounded and ended the day with a 4% loss.

This drop shows that the bank’s image is still being hurt, which could continue to hurt its stock performance in the future.

Brian Mulberry, a client portfolio manager at Zacks Investment Management, talked about what this means for Wells Fargo in the long term: “These problems show that the bank is still under a lot of scrutiny, which could delay the removal of the asset cap and hurt its growth prospects even more.”

Read More: NAFCO’s Swift Response to Maryland Seafood Food Poisoning Incident Among Employees

What Is Next for Wells Fargo?

Wells Fargo has had problems with regulators in the past. The OCC’s legal action shows how hard things are for the bank, but it also gives them a chance to show growth and a commitment to compliance.

It’s still not clear if the bank’s efforts will be enough to please regulators, but Wells Fargo has said that it is already working on many of the issues that were listed in the official deal.

As investors, regulators, and the banking industry keep a close eye on Wells Fargo, everyone will be wondering if the bank can make the changes it needs to and get the support it needs to lift the asset cap.

Until these problems are fully fixed, the future of Wells Fargo’s growth and its public image will be closely watched.